For years, my husband and I didn’t know how much money we would need to retire (you can read about our financial journey in an earlier article I wrote by clicking here). We had our guesses, with numbers anywhere between $3 million to $5 million dollars. Our logic was that by the time we’re ready to retire, our primary residence home would worth $1 million dollars (all in equity). We would also have $2 million or so dollars invested in the stock market and the dividends and interest yields from these investments would be enough to cover our annual expenses.

In that article, I also mentioned about having learned about the financial independence movement in the middle of 2016. Since then, my husband and I’ve decided that we would reach financial independence once our net worth meets 33X our annual expenses. However, in that article, I didn’t mention how we came up with the number, 33 or why we chose this particular number.

In this article, I’m sharing with you the 4% safe withdrawal rule (SWR) and what this number means for my family’s situation. In the past several months, I’ve read many written documents on the 4% SWR (some of them were more technical than others). It took me a while to understand the different strategies behind this financial planning tool. Feel free to ask me questions on the comment section below and I’ll try my best to respond and/or refer you to further readings.

The Origin of the 4% Safe Withdrawal Rule

After you’ve spent years saving toward retirement, how do you know how much money you can safely withdraw annually so that you will not outlive your money?

Your definitely don’t want to prematurely exhaust your portfolio assets. But at the same time, you probably don’t want your withdrawal rate to be so low that you’re compromising on your retirement lifestyle. This is no doubt a dilemma facing many investors looking to retire, regardless of the time period.

For some of you, your go-to resources might be personal finance books, personal financial articles and personal finance blogs. People who are already retired and seem to be doing well financially can also be of help. For others, you might go straight to your financial advisor.

Whatever your situation is, don’t go into retirement without a financial plan. If you make an error early in the process, you may not recover.

William Bengen is a retired financial advisor who has counseled many clients on how much they can safely withdraw annually from their retirement portfolios. Unlike some of his peers who used average market returns and average inflation rates to compute a number for their clients, Mr. Bengen relied on actual historical performance of investments and inflation in his techniques as he advised his clients.

According to Mr. Bengen (1994), using historical averages is fine as long a client’s financial choices (such as withdrawal rate) and market returns and inflation rate stay close to those averages year after year. However, a client’s financial situation can be in great harm when financial catastrophes, such as the Depression or the 1973-1974 recession, come about.

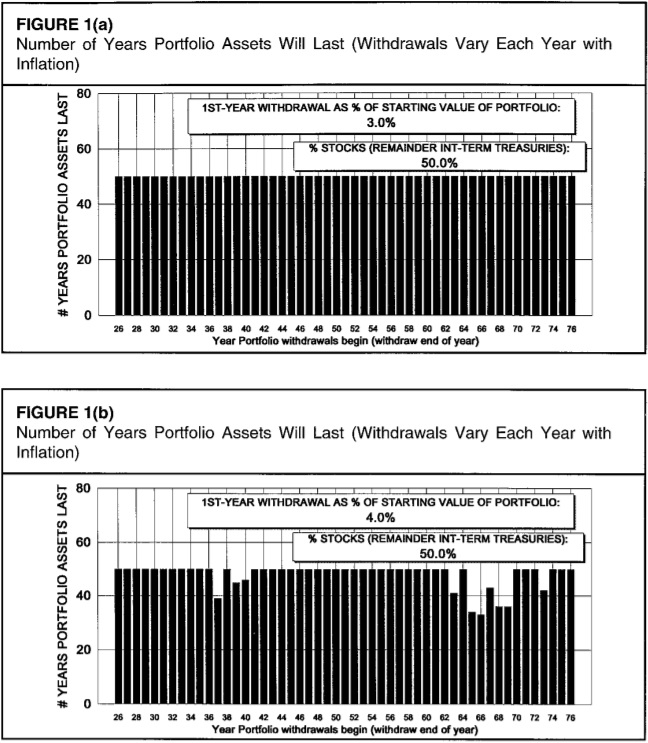

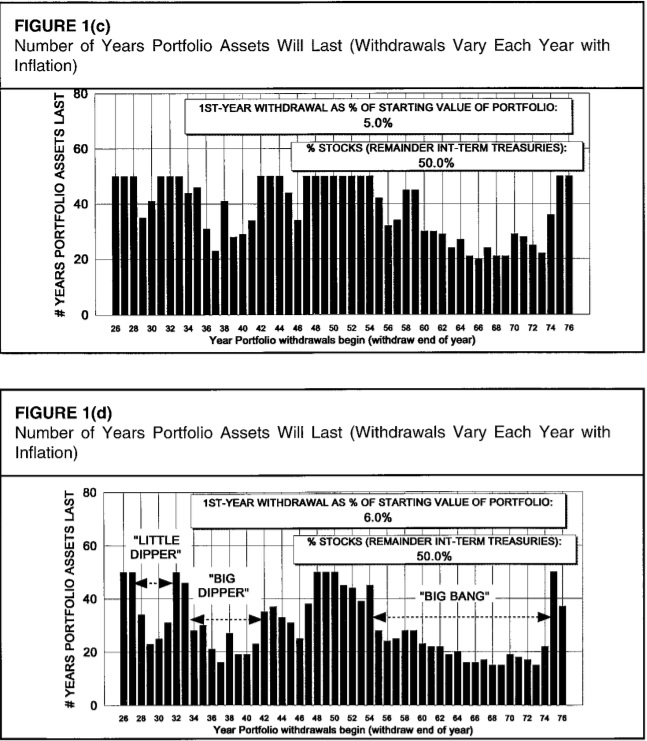

In his original paper, Mr. Bengen illustrated a series of six graphs demonstrating the relationship between number of years portfolio assets last (portfolio longevity) and withdrawal rates decisions. The data he used were actual historical performances from year 1926 to 1978, of a portfolio consisting 50% stocks and 50% bonds. During the years 1926 and 1978, three financial catastrophes occurred that severely affected market returns and inflation rates.

The basic message behind the series of graphs (such as Figure 1 (a-d)) was that (a) at a withdrawal rate of 3% (and even 3.5%), the retiree can easily have his/her portfolio asset last 50 years (and possibly even longer); (b) at a withdrawal rate of 4%, the retiree can expect his/her portfolio assets to last 30 years; and (c) at a withdrawal rate of 4.25 percent or higher, however, the retiree can expect to exhaust his/her portfolio assets in as little as 28 years. All these two scenarios accounted for inflation-adjusted withdrawals in subsequent years.

Furthermore, Mr. Bengen’s analyses showed that at a 3% withdrawal rate, the three financial events did not affect the portfolio longevity at all. At 4% withdrawal rate, the longevity was only slightly affected. At 5% withdrawal rate, however, the effects of the financial events became much more pronounced.

Based on those results, Mr. Bengen concluded that financial advisors should counsel clients “to withdraw at no more than a four-percent rate during the early years of retirement, especially if they retire early (age 60 or younger)”.

And this research became known as the 4% safe withdrawal rule:

Retirees who withdraw four percent of their initial retirement portfolio balance, and then adjust that dollar amount for inflation each year thereafter, can expect their portfolio assets to last for 30 years.

Among his works, he also studied portfolio longevity looking at portfolio assets with 75% stock allocation. When comparing the performance of these models to those portfolio assets with 50% stocks (at the same withdrawal rates), Mr. Bengen suggested that a retiree should have “stock allocation as close to 75% as possible, and in no cases less than 50%…somewhere between 50% and 75% stocks will be a client’s comfort zone.” Historically, stocks generated higher returns than bonds and a higher stock allocation has a chance to make portfolio assets last longer.

Variations to the 4% Safe Withdrawal Rule and the Trinity Study

It was over two decades ago when William Bengen first published about his extensive research on retirement withdrawal rates. The four percent concept has been replicated, expanded and criticized. Even Mr. Bengen himself refined his own recommendations. By using additional asset classes in his analysis (such as mid- and small-cap stocks), he later recommended a first-year withdrawal rate of 4.5%.

Among the researchers who came into the scene elaborating on Mr. Bengen’s work were Philip Cooley, Carl Hubbard & Daniel Walz (1998). This research became known as the Trinity Study.

Cooley and colleagues extended Mr. Bengen’s work in several directions. For instance, they investigated the effects of a wide range of withdrawal rates (3 to 12%) on portfolio longevity through overlapping payout periods of 15, 20, 25, and 30 years. They also used five asset mixes (from 100% stocks to 100% bonds). Furthermore, the Trinity Study examined the most recent 50-year period (1946-1995) as well as the entire database (1926-1995).

The conclusions drawn from the Trinity Study were similar to those articulated in Mr. Bengen’s publications. According to Cooley and colleagues, retirees who expect long payout periods should choose an asset allocation that is at least 50% stocks allocation and a lower withdrawal rate. For shorter payout periods, such as 15 or 20 years, a higher withdrawal rate such as 8% or 9% should be sustainable, provided the portfolio has a substantial percentage of stocks. Retirees who plan to make inflation-adjusted withdrawals should choose lower withdrawal rates and invest at least 50% of the portfolio in stocks.

As to the 4% safe withdrawal rule recommended by Mr. Bengen, the Trinity Study researchers suggested that withdrawal rates of 3% and 4% appeared to be excessively conservative for portfolios with at least 50% stocks, unless the retiree wishes to leave a substantial portion of the initial retirement portfolio to his/her heirs. Their research showed a portfolio success rate of 100% at the 3% withdrawal rate and at least 98% at the 4% withdrawal rate.

Is 4% Really the Magic Number?

The 4% safe withdrawal rule is probably one of the most widely referenced financial rules of thumb. However, it’s not a prescriptive retirement rule to be applied across people, situations or time periods (Read some of my other articles on financial rules of thumb here and here).

First, Mr. Bengen’s research and the Trinity Study relied on historical data and looked at how various withdrawal rates would have fared based on past market returns and inflation rates. These researchers didn’t make any predictions or promises about future returns. Even though the historical market data from 1926 to 1995 covered a wide range of market and economic conditions, the future is still uncertain. As Mr. Bengen himself pointed out, “…the future could hold surprises more harmful than the “worse than worst case” I examined…”.

Second, personal behavioral traits, circumstances and goals also make it difficult to prescribe a single withdrawal rate for every retiree. While you might wish to bequeath a large estate to your heirs, your neighbor next door might want to live a high retirement lifestyle and considers a portfolio with a terminal value of anything greater than $1 a success.

As another example, your friend might be okay picking up work to make some extra income (thus, reducing his/her withdrawal rate) during years of low market returns but you aren’t. Thus, the 4% withdrawal rule, at its best, should only serve as a financial planning tool and perhaps a starting point as you do retirement planning.

How Does the 4% Safe Withdrawal Rate Actually Work?

I often read that you’ll arrive at your magic retirement number if you multiply your annual spending by 25 (this is assuming a 4% withdrawal rate). In other words, figure out what your annual spending is and then multiple that number by 25.

So, if your annual spending is $40,000, do the math and you’ll arrive at $1 million dollars. This $1 million dollar in net worth is 25X your annual spending of $40,000.

The actual formula is: Portfolio Assets = Annual Spending / Withdrawal Rate

The formula can also be written as: Portfolio Assets = Annual Spending x (1 / Withdrawal Rate)

Let me give you my family’s situation as another example. In this article, I shared that our anticipated annual spending will be around $50,000 once we retired (no more child care expenses). From my limited knowledge, many early retirees are comfortable having a retirement portfolio of 25X their annual expenses. When we set out on this financial independence journey back in June 2016, our aim has been 30X to 33X, which is anywhere between $1.5 million to $1.65 million. This way, we are building more cushion into our portfolio longevity.

How Can You Improve Your Chance of Outliving Your Portfolio Assets?

As stated above, one way to improve your chance of outliving your portfolio assets is having a larger retirement portfolio to support your retirement lifestyle. If your annual spending is $40,000, wouldn’t you have like to have a retirement portfolio of $2 million dollars? This amount is 50X your annual spending! However, for many of us, there’s a big tradeoff to achieve a larger portfolio; you’ll most likely have to work longer to accumulate more wealth. Is that worth it to you (and your family)?

My husband and I have been thinking about this tradeoff a lot lately. We have been so tempted to just be happy with having the 30X and begin the next chapter of our lives doing whatever we want.

There are certainly other ways to increase your portfolio longevity. Your retirement withdrawal plan does not have to be static and you can modify it at any time during retirement. Always keep an open mind and be flexible. Remember, all the resources that are available to you and I are just financial planning tools. Use them to help you come up with a roadmap and modify (and continue to monitor and modify if necessary) these tactics and strategies to meet your own unique needs.

Reduce Spending

When the market is giving you mediocre or negative returns, you can always choose to reduce your retirement spending. This may be the best solution as it doesn’t depend on the fickle performance of markets but on factors that you can control completely (such as delaying on your next vacation). Lowering your spending will decrease your level of withdrawals and give your retirement portfolio a chance to recover and/or accumulate more wealth. Once the market recovers, you can then choose to resume your original withdrawal rate. The key here is doing continuous monitoring of your finances and being flexible.

Increase Income

Depending on the age when you retire and the condition of your health, this option may or may not be feasible for you. If you’re an early retiree and have the health to do so, working a side hustle to increase your income during low economic years is certainly a good idea. When times get hard, you should be open to going back to work full-time, too.

And if the market gets very bad, do both at the same time: reduce spending and increase income. The take away message is that you don’t have to be stuck with a certain retirement plan. Even when the market gives average returns, it’s always a good idea to reevaluate your plan once a year to make sure you’re still on your retirement track.

Sequence of Investment Returns Matter

According to Mr. Bengen, sequence of investment returns is another factor that’s crucial for portfolio longevity. In an ideal situation, you will want to retire during a time when the stock market is undervalued and your retirement portfolio has a good chance to grow.

The average market returns throughout your retirement years don’t matter much here. What you should be concerned about is your portfolio performance during the first decade of your retirement.

The logic is that if your retirement portfolio performs well during those first 10 years or so, you will have accumulated so much wealth that you shouldn’t have to worry about a big potential downtown in the market in future years. On the other hand, if you retire and the first decade of your retirement gives low returns, your portfolio assets might get depleted much sooner than projected.

To ensure a higher portfolio survival rate, smart investors looking to retire typically set aside 1 to 3 years of cash reserves to support the first few years of their retirement spending. This way, they won’t feel the need to dip into their portfolio assets when the market doesn’t perform well.

While market returns matter, the inflation rate during the first decade of retirement also plays a role in how long your portfolio assets will last. By design, the 4% safe withdrawal rate takes inflation into account. When there’s high inflation in the early years in retirement, this can result in a rapid escalation of withdrawals and depletion of the portfolio. This is because your money has less purchasing power.

In the words of Mr. Bengen: “Take some pre-emptive action, no matter how mild, when the current withdrawal rate first exceeds the initial (or expected) withdrawal rate by 25%…If, despite initial action, withdrawal rates continue to rise, take more aggressive action…One can always increase withdrawal rates if favorable investment conditions reassert themselves later in retirement. But it’s really tough to deal with double-digit withdrawal rates. Don’t let them get that high…one can’t be sure what’s around the next investment bend. At worst, the retiree will leave behind a bit more money than he expected. I submit that’s much better than running short.”

********

As with any research studies and findings, there are always limitations and caveats. Mr. Bengen’s research on retirement withdrawal rates and the Trinity Study are no different. If you have the time, I encourage you to read the authors’ original papers. I always like going to the original sources for information.

What do you think about the research on retirement withdrawal rates?

Now that you’re aware of the 4% safe withdrawal rate strategy (and its variations), will you incorporate this knowledge in your future financial planning?

Like what you’ve just read? Sign up for my free weekly newsletter to receive new post updates.

We use Personal Capital, a free financial tool, to track our net worth, view our investment performance, analyze our asset allocations and project our retirement goals. See my comprehensive review of the software here.

Rusty Best

February 14, 2017Thanks for this tremendously good write-up. It’s so very helpful and thoughtful, and the fact that you summarized so much of your research so succinctly and clearly…it’s an appreciated gift! -Rusty

Nina

February 14, 2017Rusty, thank you for your kind words. I’m happy you enjoyed reading this article and found it useful. I certainly had a great time writing it and learned a lot along the way. Nina

Evan Inglis

May 18, 2017Take a look at the Feel Free retirement spending approach – it’s an update to the 4% rule for today’s lower return environment.

https://www.soa.org/News-and-Publications/Publications/Essays/2016-diverse-risk-essays.aspx

Nina

May 18, 2017Evan, thanks for sharing your work and insights with this community. Ideally, my husband and I want to use the conservative 3% withdrawal rule, not the 4%. We’ve been looking at other ways to diversify our non-W2 incomes so that we soon won’t have to depend on W-2 income to get us to that magic number. I read your Feel Free retirement spending approach and have to say that’s EXTREMELY conservative for my family’s situation :). I retired from my W-2 employment recently. According to that rule, I should plan to spend 1.5% of my assets. To have enough money to cover my family’s annual expenses, I’d need about $4 million in assets. For a couple like us in our mid 30s (average age), that’d be a lot of money to have. If the compound effect is true, we’d have over $30 million dollars in assets when we get to our 60s :).

Evan

May 18, 2017Holy mackerel – didn’t realize you are aiming for mid-30’s! That’s awesome. Obviously the feel free approach is a rule of thumb and targeted at more typical retirement ages, still…. One way I would think about your situation is to compare your spending % to expected real rates of return (after taxes and fees). Net real rates of return in the coming decades seem likely to be in the 1.5% to 3.5% percent range (e.g. figure 4% real return on stocks, 2% on bonds and then subtract fees & taxes). To the extent you are spending at the high end of that range you are likely to gradually spend down your portfolio on an inflation adjusted basis (and therefore gradually be able to buy less and less). Spending at the low end of that range in the beginning is likely to be safe and keep in mind you can increase your spending rate as you get older. The 4% rule was developed in a bygone age when our investment returns were still being pushed up by decreasing interest rates and we are only now transitioning out of that world into a future where returns are likely to be significantly lower. You seem savvy enough to navigate your future financial situation and the “feel free” approach is really for someone who is not an expert and wants assurance that their spending is OK, so I think you are OK to be more aggressive. Just make sure to factor lower future returns into your analyses. Good luck!!