It’s already April and I just got around to sharing our February non-W2 incomes report. A lot has happened in my family in the past month. Some of the changes and adventures included giving my resignation letter to my previous employer and possibly forever saying goodbye to W-2 employment and taking a road trip across the country.

There are two great things I’ve came to love about non-W2 incomes; one being having incomes coming in to cover my expenses while on vacation and that, two, these incomes are location independent (e.g., I can be anywhere in the world and still continue to receive dividend/interest payments.).

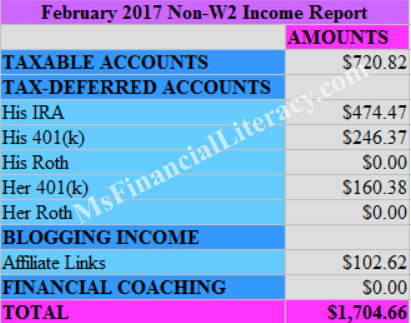

You’ve probably noticed the few “$0”s on the table above. First, I was surprised we didn’t receive any dividends/interest payments on either one of our Roth accounts. Second, there was no financial coaching income for February. We were busy preparing for taxes and for the adventure across the country.

All things considered, the total for February was only couple hundred dollars lower than that of January. We are optimistic that the March total will be much higher. Many of our investments either pay dividends/interests quarterly or pay out higher amounts on the quarter mark. Come back to the blog to see the March report soon. You can view my previous non-W2 income reports here.

We use Personal Capital, a free financial tool, to track our net worth, view our investment performance, analyze our asset allocations and project our retirement goals. I wrote a comprehensive review of Personal Capital on another post. I encourage you to check it out.

Like what you’ve just read? Sign up for my free weekly newsletter to receive new post updates.

Steven Davis

April 4, 2017I’m wondering how you receive any money from these accounts since you’re not 59.5 years old yet.

Nina

April 4, 2017Hi Steve,

The dividend and interest money can be taken from the taxable account at anytime without tax or early withdrawal penalty. That money can then be used to fund Roth IRAs (with the annual contribution limits applying of course).

For Roth IRAs, there is a 5 year rule where the original contributions can be withdrawn after they’ve sat for 5 years. However, any investment gains cannot.

For traditional IRAs, there are two ways: a Roth conversion ladder and a SEPP 72t. Of those two, the Roth conversion ladder is more generally suited to most high savers. I’ll have a post in the future covering a Roth conversion ladder.

401Ks can be rolled over to traditional IRAs (see above) upon switching jobs or ending employment.