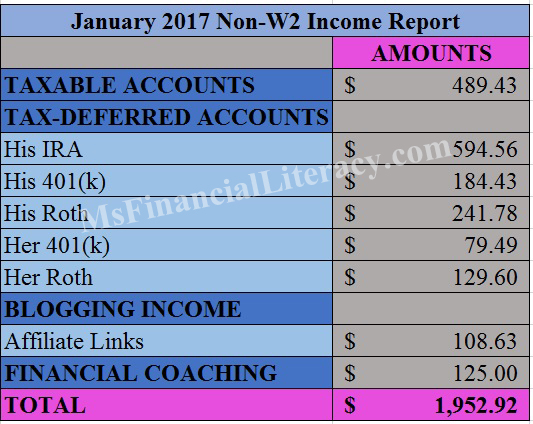

Last month, I started sharing our non-W2 monthly incomes. In that article, I also shared why we’re doing this on the blog. Yesterday, my husband and I summed our financial numbers. Below is a chart listing our non-W2 income sources and totals for January 2017.

As anticipated in last month’s report, we expected January’s numbers to be much lower compared to those of December 2016.

From my understanding, most early retirees in the Financial Independence and Retiring Early (FIRE) community fall in one of two groups when it comes to funding their early retirement lifestyles:

(1) The passive incomes from their investments (such as dividend money and interest yields from the stock market and cashflow from real estate investments) completely cover their annual expenses during retirement.

(2) The passive incomes from their investments cover part of their annual expenses AND they also withdraw from their retirement portfolio (the principal) to make up the difference between their passive incomes and expenses.

How do you know how much is safe to withdraw and have money to last through your retirement years?

Three professors of finance at Trinity University introduced the “4% safe withdrawal rule”. This rule simply states that if you’ve saved 25X your annual expenses, you should be in good financial standing to retire.

For instance, if your annual expense is $50,000, then you’d need to save $1,250,000 ($50,000 x (100/4)) in savings. According to the authors of the study, a 3% withdrawal rule is considered conservative. In this case, you would need $1,666,666 ($50,000 x (100/3)) in savings.

Certainly, the numbers aren’t so black and white for most people. In a later article, I will discuss more about the 4% rule and what the numbers mean for us when we leave our 9-5 jobs. Watch for that post.

This is it for January. My husband and I expect our February numbers to be on the low side, too. We’ll let you know a month from now :).

We use Personal Capital, a free financial tool, to track our net worth, view our investment performance, analyze our asset allocations and project our retirement goals. See my comprehensive review of the software here.

Like what you’ve just read? Sign up for my free weekly newsletter to receive new post updates.

Dividend Driven

February 4, 2017Thanks for sharing your dividend income from your investments and it appears you are starting 2017 in a great position.

Nina

February 14, 2017Thank you for stopping by. I want to show others what’s financially possible through the combined act of high savings rate and diligent investing. Looks like we’re both on the same track doing something meaningful :).

Mustard Seed Money

February 11, 2017Looks like you had a really great month of January!!! I could only imagine over $100 in affiliate income 🙂

Nina

February 14, 2017The affiliate income definitely has been sweet surprises! Looking at ways to reinvest this money back into the blog.