In this article, I share our financial freedom number, our 2017 bi-annual recap of non-W2 incomes and the wealth building strategies we use to grow our daily worth.

Our Financial Freedom Number

A little over a year ago, I started taking my financial learning seriously (you can read my story here). I read that financial freedom (financial independence) is reached when one has enough passive and/or residual incomes to cover all basic expenses. Certainly, “basic” is a relative word, however you’d like to define that for yourself or your household.

My husband and I have calculated that our basic monthly expenses is about $3,500. This number includes $1400 for housing (utilities included), $1,000 on groceries plus dining out/entertainment once per week; $300 on personal/household expenses, $80 on phone services, $250 on various insurances we carry, $200 on vacation, $120 on gas/car, $50 for charity, and $100 on the unaccounted items/events (e.g., gifts).

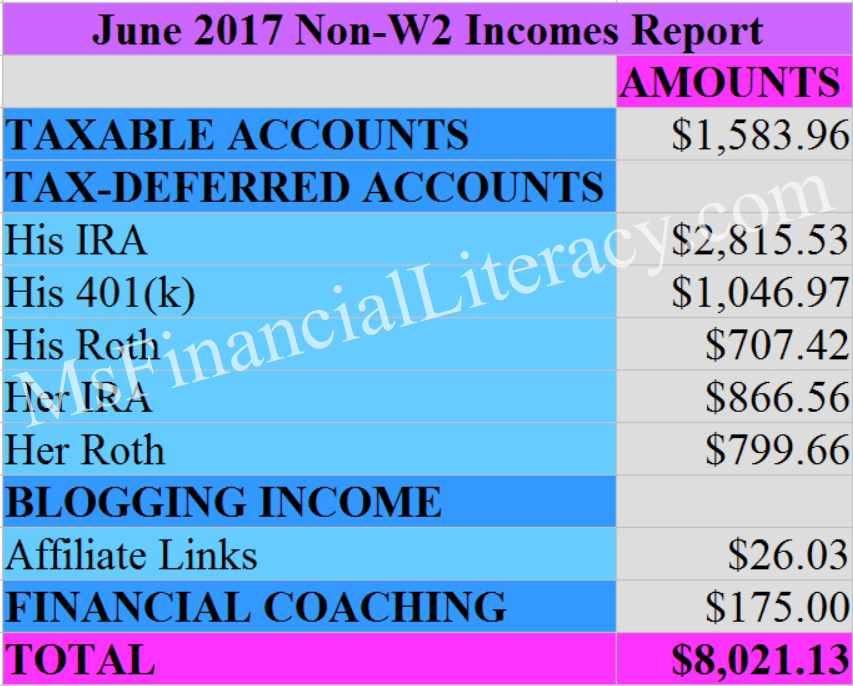

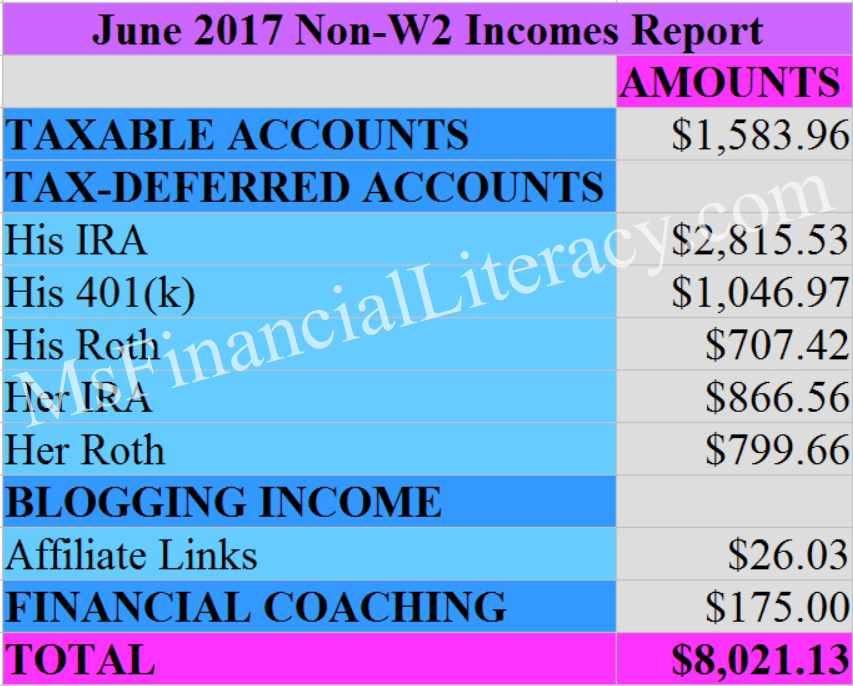

June 2017 Non-W2 Incomes Report and Bi-annual Recap

Once we summed up our June 2017 non-W2 incomes and did a bi-annual recap, the numbers in front of us confirmed that we’ve reached the financial freedom stage.

Below is a chart detailing our June report.

For months, we anticipated that June was going to be an amazing month for us. To our surprise, the total amount we received way exceeded our expectations. This number is bigger than the one from our December 2016 report (typically, December is supposed to be the best month for dividends/interest payouts).

If you follow our previous 2017 non-W2 income reports up to June, our average is $3,528.23 = [($8,021.13 + $2,142.44 + $2098.93 + $5,249.31 + $1,704.66 + $1,952.92)] / 6 months

This $3,528.23 number is very close to our estimated monthly expenses. By definition, my family and I have currently reached the financial freedom stage.

Wealth Building Strategies We Use

My husband and I attribute this favorable return on our investments on the following factors:

(1) We continue to have a high savings rate;

(2) We continue to build our investment portfolio using our savings;

(3) Having a well-managed investment portfolio (we slightly adjusted our asset allocations back in September 2016 – types of equities, percentages and diversification);

(4) We continue to learn new things financially and put new knowledge into actions;

(5) We openly talk about and discuss money topics with others (once in a while we learn something new in the process); and

(6) We use Personal Capital, a free financial tool, to track our net worth, view our investment performance, analyze our asset allocations and project our retirement goals. I wrote a comprehensive review of Personal Capital on another post. I encourage you to check it out.

Like what you’ve just read? I invite you to go to my sidebar and sign up for my free weekly newsletter to receive new post updates.