The Onset

I recently went through a pretty dark period in my life. Back in late 2016, when my husband brought up the topic of early retirement for both of us, I suddenly found myself going down the rabbit hole of fearing there’s “not enough”.

By that point, he and I have reached a consensus that we’d be in a great financial position to retire (for both of us) within the next year or two. That was our agreed terms, so I thought (I soon learned that was really the terms I put on our relationship). There was a certain financial number I (and only I) wanted us to reach. That was the number I was comfortable with. I don’t know why I was so stickle about that particular number. Maybe I like the sound of it. Maybe I like the roundness of that certain number. Maybe I like having extra built-in cushions in our finances before having both of us retired from our jobs. Whatever the reason(s) might be, I was adamant about reaching that magic and comforting number.

In the fields of economics and psychology, one living with the fears of “not enough” is said to be living with a scarcity mentality (or mindset). If you google “scarcity mentality” and read some of what’s been written, you’d quickly gather that living life with a scarcity mentality can be limiting and debilitating.

For me, I tie much of my sense of security to money. I don’t need to have a lot of money. However, when we’re talking about early retirement, I’d have liked to have reached a certain amount of money before I can feel safe. Both my husband and I had very good compensation benefits. Those benefits were a big part of my family’s safety net. In this blog, I’ve spent a lot of time talking about the awesomeness of reaching financial independence and early retirement (see here and here). What I left out was my fear of giving up all the great benefits that came with W-2 employment (see here). The thought of having to let go of all that safety net seemed scary, overwhelming and wasteful. And I cringed at the thought of all that we’d lose when we leave our employment.

Naturally, feelings and thoughts of scarcity started creeping into my head and I found myself in a big mess. Consequently, the quality of my marriage and family life suffered. My mental and emotional health had also suffered.

Shedding Some Light into this New Mental State Experience

When those thoughts and feelings of “not having enough” washed over me and my life, I didn’t have a label for them. It was only after months of reading and self-discovery that I’ve came to associate that mental state with “scarcity mentality”.

I was surprised at the onset of such manifestations within me. As I read about the typical profile of someone with a scarcity mentality, I could identify with some characteristics and not others. And all the while I was doing research on this topic, I kept wondering how I’ve come to acquire this form of mindset.

According to my readings, children growing up in families with limited resources are more likely to develop a scarcity mindset. And that adults living in poverty are more likely to have a scarcity mentality than those with more money.

When I examined my own life, my story doesn’t really fit that picture. For the first decade of my life, I was definitely living in a middle class income family. My dad earned good money and provided my family and I a great life back in China. As an adult, despite having lived on a student budget for almost a decade, I never felt I was poor. As I mentioned in an earlier article, I felt rich seeing $20,000 or so in my bank account. Once I married my husband and for years afterward, I felt we were doing well financially. Putting my own internal struggles aside, we were always in a great financial position to afford the things I wanted, which included some very expensive items and travels.

So, you can imagine my surprise when I learned I have a scarcity mentality. I didn’t see this development coming. I didn’t see myself as a hoarder. If anything, having too many things overwhelms and distresses me. To go further, seeing other people engaging in the hoarder mentality also distresses me.

In my family, my mother likes to hoard resources that are vital for life, such as food items. Each time I go home to visit, the refrigerator and freezer are always at maximum capacity. With an overflowing refrigerator, it’s very difficult to see what’s already being stored and easy to purchase duplicates. This act typically results in much food being wasted. I feel sad and become frustrated when I see food being wasted. These feelings are especially strong when I know the waste could have been prevented.

Growing up as a child, I don’t recall my mother having this kind of food hoarding behavior. She was a stay-at-home mom and had time to plan her meals and shopping. Once she immigrated to the U.S., she had to take on a job to help support the family. This change in lifestyle probably changed her perception of time. She has been behaving as if she’s running out of time most of the time.

Watching how she has been suffering with her lack of time, I swore to myself that I’d never allow myself to become that way. Yet, once I became a parent and went back to work after maternity leave, I could see myself more and more feeling pressed for time each day. I feel like I could use 32 hours in a day.

As I reflected, I wondered if I am subconsciously following my mother’s footsteps as I took on the role of a parent. It didn’t matter that I disapprove those lifestyles and/or behaviors. Do these manifestations have to do with genetics? observational learning? the modern life of parenthood? The psychologist in me kept wondering, pondering and reflecting.

Despite having a scarcity mentality toward time and somewhat suffering from this form of mental state, it never reached a point where it was so bad that I felt the need to do something about my thought processes. Occasionally, my husband would comment about the way I perceive time when I attempt to control how he uses his time. His perception of time is somewhat on the opposite spectrum compared to mine. When he was drinking coffee, ideally, he would have liked to have two hours to enjoy his coffee along with the rest of his morning routine.

As another example, I find myself complaining to him about how he uses his time inefficiently to do certain tasks. This mismatch on our perceptions of time does get us in trouble with each other, and hurts our relationship. However, as I stated, I either refused to see the problems arising in my marriage or I was a fool believing that there were no issue. Thus, I didn’t take actions to make positive changes.

Living with a Scarcity Mentality

That was, until late in year 2016 when my husband mentioned about early retirement for both of us. As soon as he said the words, I found myself manifesting feelings and behaviors of financial insecurity. For months, I tried to negotiate with him on a certain number goal. I told him, “I’d feel okay with you retiring once we reached this certain number”. I recall even begging him to work with me.

Even though he agreed to my terms, each day I could feel his strong desire to be done with his employment. I could feel his struggles growing stronger by day. I could hear and feel his pains. I, too, felt pains through his pains. Yet, I failed being a good spouse to him. I was too busy having enveloped myself in a scarcity mode.

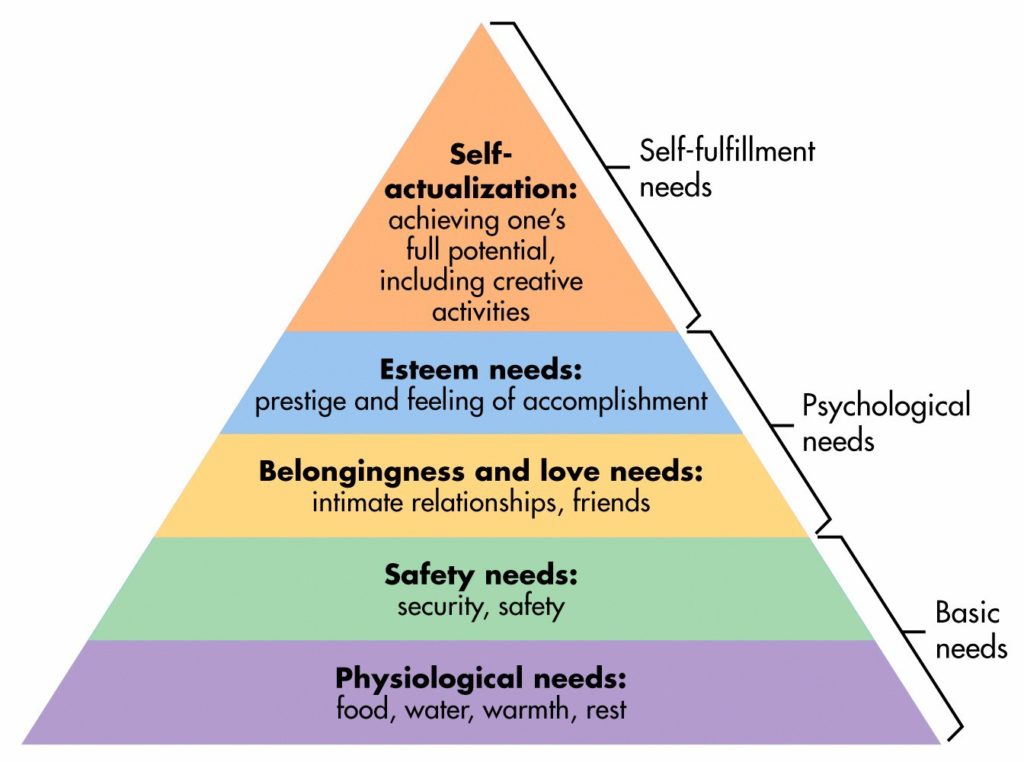

If you’re familiar with Maslow’s Hierarchy of Needs (image source), then you’d know that security and safety needs are human basic needs.

According to Maslow, human beings have to have certain basic needs met before we can progress on to meet higher levels of growth needs, such as being a good spouse and a good parent.

For months, the fear of not having enough was all I could think about. I refused to listen to my husband. I refused to look at our financial number objectively. I refused to see the math. I refused to apply all I had read on personal finances and early retirement in the past year. I consciously rejected all logic. My fear consumed me and I focused on it obsessively.

I started feeling poor. I started getting anxious about spending money. I felt like all my dreams of travel, having the home I want, the education I’d like to give our daughter, etc., were taken away from me. Of course, all these thoughts and perceptions were only in my head. Our number would have told me otherwise. However, I refused to see or listen. As a result, I was going through an emotional mess.

At various points, I was disappointed, sad, frustrated, angry and hurt. And I failed to take care of myself, my husband and my daughter. That time period was pretty dark for my family and I. My husband offered to help me. He suggested counseling and recommended books for me to read. I dismissed all his suggestions and blamed him for my own misery.

At one point, I read being constantly in scarcity mode is correlated to having a tunnel vision of life. When we engage in these kinds of thought processes, we can lose sight of the larger picture and more important priorities. For me, that was very true. My husband eventually came to resent me, even though he was careful not to put it this way. And that took a big toll on our marriage. It’s been over a month since I gave my husband the permission to retire, he and I are still working on repairing our relationship.

Concluding Remarks

In retrospect, I wasn’t ready. Perhaps I needed to go through the pain and suffering. It was a process for me, and I’d need to learn to come around it at my own pace.

To this date, I still don’t understand how I’ve come to develop this scarcity mentality toward money. It’s embarrassing admitting this to myself. Many would say I am ungrateful. I try not to be too hard on myself. Having this scarcity mentality is not something I’m proud of. I’m learning to come to peace with it and do something about changing my thought processes.

The opposite of a scarcity mentality is having an abundance mentality. Even though a lot has been written on these two topics, there’s the saying that intellectual knowledge doesn’t translate into much unless one also practices what’s being read. The challenge for me nowadays is to practice what I read. I’ll be sure to write a follow-up post.

If you’ve been a reader of this blog for a while, you’d know that my husband and I aren’t always on congruent terms when it comes to our perceptions of money. Despite having achieved a scoreboard that we are both proud of, along this journey we’ve argued about money. Yet, we each time we’ve managed to resolve our differences. At the core, both of us hold very similar beliefs regarding building wealth, managing and preserving our money and contributing to charity. Those shared traits are what have helped us achieve our financial goals and become an early retiree family. Nowadays, my husband and I (along with our daughter) have made a pact working on developing an abundance mindset and practicing gratitude.

In the comments section below, I’d love to hear your thoughts and stories relating to the topics discussed in this post.

Like what you’ve just read? I encourage you to subscribe to my free weekly newsletter that goes out every Monday to receive updates on new posts. Please share my blog and contents with your family and friends, too. Financial literacy is one of the best gifts you can give yourself and loved ones.

To sign up for my free weekly newsletter, use the newsletter button provided below or go to the website’s sidebar.

Theresa Seibold

October 2, 2017Gratefulness is definitely the key to a mindset of abundance! Even in difficult times or times of actual scarcity, there is always something to be grateful for. I’ve heard it said that there are two animals inside us: One is a fierce Brave Protective Lion and the other is a destructive Greedy, Selfish, Self-absorbed Wolf. Which one are you going to feed?

Love & blessings to my family on this journey we call Life! MomS🙇👼😇

Nina

October 4, 2017I’m not clear how the Brave Protective Lion and the Greedy, Selfish, Self-absorbed Wolf are related to abundance and scarcity mindsets.

It might be too far-stretched to suggest that one who has a scarcity mentality is greedy. One’s sense of security, whether that’s physical or financial, is subjective. As for myself, I just want to feel protected (for both myself and my family) and have the extra cushion to cover for rainy days. We gave up a lot (of safety net) when we both left our jobs (we certainly gained a lot, too). And that was scary for me. I don’t need super wealth or power. Having some extra money in the bank shouldn’t make one greedy. Would you say that’s being greedy?

Many people live with a scarcity mindset; some aren’t even aware; some are struggling with this every day; some are suffering. It’s important that we don’t put such negative labels (such as greedy, selfish and self-absorbed) on these mental processes. Many of us don’t wake up in the morning and say to ourselves, “okay, I’m going to go through my day carrying a scarcity mindset”. There’s much to become aware, understand and work on. What we need are awareness, education, compassion (including self-compassion) and support.

Vanessa

October 2, 2017Love reading this – thank you for being so honest and real and sharing your personal experiences so openly. It’s helpful to understand that even with success and financial security, there can still be disagreements, struggle, and stress. It helps to understand there are terms that apply to these states, and your journey (which continues) to find peace in it all – both in yourself and with your husband. Really enjoyed the read and appreciate you taking the time to share.

Nina

October 4, 2017Vanessa, thank you for taking the time to leave such heartfelt comment. I chose to be open and authentic with readers of this blog. Money topics and personal finance discussions don’t naturally come up in conversations with family and friends, yet, much learning can occur this way. Through this blog and my other works, I aim to inspire and encourage others to become more comfortable and have more confidence talking about money and managing money. I have several good articles I recommend in the following link:

http://www.msfinancialliteracy.com/spreading-financial-awareness-financial-education-among-women/

You put it beautifully when you wrote…”even with success and financial security, there can still be disagreements, struggle, and stress.” Personal and relationship (family) development are of many layers and dimensions. I strive to become a more rounded person each day. I consider myself to be very good with personal finances, but somewhat lacking in other areas of life.