We’re sharing our non-W2 incomes on the blog not to brag. We want to show you what is financially possible. If you’ve read some of my previous articles (such here, here, here and here), you know that both my husband and I have been saving aggressively over the past decade. Our savings rate ranged from 55% to 75%. This was true even when our combined income was below $100,000. The total passive income number you’ll be seeing here is the result of a decade of financial discipline and strategic investing. We took no shortcuts nor did we stumble upon great luck.

In our household, our biggest financial goal currently is to build up our non-W2 income. Sometime in the near future, my husband and I will want to leave our W-2 employment. At that time, we want our annual non-W2 income to cover our annual expenses. Ideally, we prefer 95% to 100% of expenses will be covered by our passive income sources (such as from dividends and interest payments from stocks and bonds and income from rental properties) and anything beyond that would be a bonus/extra cushion. We are certainly not there yet; we currently have enough passive income to cover our basic expenses. This is the reason we’re looking into rental properties to fill the gap (click here to read my rental property investing series where I share our journey on this new adventure).

Part of financial planning is financial tracking.

My husband and I did a lot of this in the latter part of year 2016. If you want to reach certain financial goals, you need to first get a good picture of your current financial life, then determine how to get there and then take necessary actions to fill the gap. As mentioned in a previous article, for years my husband and I managed and tracked our financial numbers on a notebook and notepad. As we have 10 plus financial accounts, the tracking was tedious and messy.

At one point, my husband and I agreed that we needed a better system managing and tracking our finances. This was where Personal Capital came in. Once we started using the free financial tools this software provides, I became extremely excited reviewing and analyzing our portfolio performance on a daily basis. Suddenly, all our financial numbers are in one place and I can see how our different investments (or asset classes) interact with each other. From there, my husband and I can plan accordingly and strategically to make our money work harder for us. We do this by looking at our retirement time frame, lifestyle, risk tolerance level and tax planning.

Before we started using Personal Capital, my husband and I summed our net worth once a month (more or less). We had to log into each of our financial accounts to get the totals. With Personal Capital, we know our net worth daily. The number is right on the software’s beautiful Dashboard! While there, we can also see how our portfolio does relative to the various markets and indices. This is a very awesome feature. In our portfolio, we have individual stocks, bond funds, stock index funds and international stock index funds. It’s just very neat being able to see how the various asset classes compare at the end of a trading day.

We highly recommend using Personal Capital’s free tools to help you with your financial planning and financial tracking. You can read my complete review here. If you decided to sign up for a free account, come back to this blog and let me know if you’re a fan. I have the feeling you will. I always love looking at my savings, but I didn’t know financial tracking can be so much fun, too, until I started using Personal Capital’s free financial tools.

Once we started using Personal Capital to track our finances, my husband and I also decided to track our passive incomes. For months, we talked about how much passive income we would need on an annual basis so that all our expenses are covered. We speculated how much passive income we have (such as messily averaging our yields of our stocks and bonds holdings), but we really didn’t know. As our goal is to reach a number where we no longer have to depend on our W-2 income, it just made sense at the time that we start tracking our passive income.

This means logging into our financial accounts and getting the payout numbers for each month and then summing up the total at the end of the year to get the total annual number. We care about the annual number because our dividend and interest payments vary month to month. In another article, I talked about how it would be nice to have some of our passive incomes coming in every month on more consistent basis. In that article, I also shared what my husband and I are doing to make this financial goal happen.

******

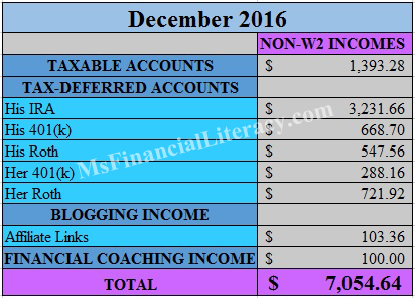

As you look at the numbers, it’s important to keep in mind that the total varies from month to month throughout the year. December happened to be a great month for us. We have a lot of holdings in U.S. and international stock index funds. These asset classes typically pay a much portion of their yields quarterly, bi-annually or annually. And the month of December happens to fit in the quarterly, bi-annual and annual schedule (as it is divisible by 3, 6 and 12).

The asset classes that pay quarterly typically do so in the last month of the quarter. Come the month of February, our total is likely to be very low. This is the very reason why we’re venturing out to build some passive income that are more regular on a month to month basis.

We’ll have to pay dividend taxes on the passive income in our taxable accounts, but only a portion of that $1,393.28. Part of this amount is interest payment from municipal bonds, and those bond funds are tax-exempt. As the name on tax-deferred accounts implies, dividend and interest incomes in these accounts are tax-exempt.

The income from blogging and financial coaching were surprises. First, we didn’t expect to be getting any blogging income. My friends who blog told me that their blogging revenues typically started around the 6-months to 1 year mark. Second, when my husband’s friend reached out to him for some financial coaching, my husband was happy to provide the service free of charge. However, his friend insisted that he compensate my husband for his time.

All in all, our total non-W2 income for the month of December 2016 was $7,054.64. We expect this total to be much lower in the upcoming months.

Were you familiar with the concept of passive income?

Have you been thinking about passive income the way that my husband and I have (building enough passive income to cover your annual expenses)?

If you’ve been tracking your financial numbers, what system do you have in place?