In Part II of A Woman’s Financial Responsibilities in Her Household, I discuss some of the barriers women face on our way to become financially literate, and how the men (e.g., husbands, fathers, grandfathers, brothers, friends) in our lives can help. In part I, I discussed some gender generalizations regarding how money responsibilities are handled in a typical household and shared some intropsection I have regarding my situation during the earlier years of my marriage.

Women are eager for information about financial planning and investing. In the 2014-2015 Prudential Study, Financial Experience & Behaviors Among Women, 18% of the women surveyed (survey polled 1,407 American women between ages of 25 and 68) said they would like to be more involved in financial decisions that affect them and their households. As another example, Fidelity Investments (Money Fit Women Study, 2015) found 92% of surveyed women (total respondents = 1,542 women ages 18+) wanted to learn more about financial planning, 75% wanted to learn more about money and investing and 83% wanted to get more involved in their finances within the next year. Yet, despite these statistics demonstrating women wanting to get more engaged with our finances, many of us exhibit a great amount of discomfort with our abilities to make wise financial decisions. We’re more confident in the ability of our spouses/partners to assume full financial responsibilities of long-term financial planning than our own.

Barriers to Women’s Financial Competence

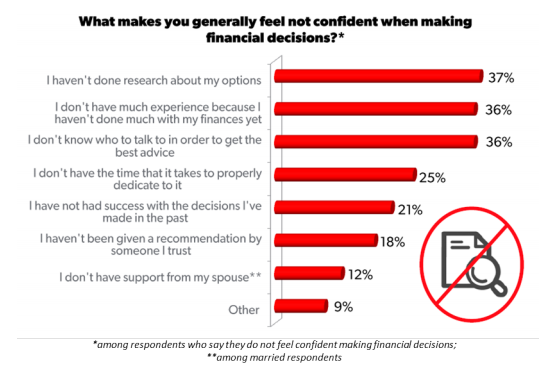

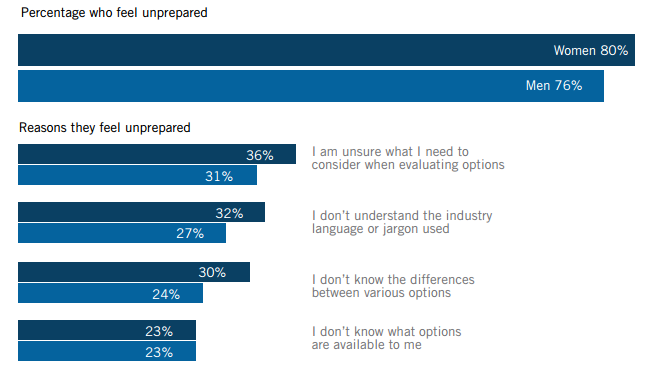

Let’s take a look at some of the reasons women in general feel unprepared or not confident making financial decisions.

Fidelity Investments 2015 Money Fit study:

2014-2015 Prudential study on Financial Experience & Behaviors Among Women:

In sum, the barriers to women’s financial competence tend to fall under the six following categories: (1) lack time, (2) lack financial knowledge, (3) lack trust of the financial industry, (4) lack confidence, (5) lack hands on experience managing money and (6) lack support from spouse. Not surprisingly, few of these barriers are related.

If we can break two or more of these barriers the success rate to increase financial literacy among women is likely to go up. For instance, a woman with a spouse who fully supports her to pursue financial literacy is likely to have more time learning about personal finance and financial planning. The husband would be more likely to take over more household chores so that the wife can pursue her interest. As the woman begins to learn financial literacy, she will learn to read and speak the financial language. In the process doing so, she will learn about the different financial services and products.

As she’s learning she will likely discuss her newly acquired knowledge with her family members and friends. When it’s time to hire a finance professional, this woman will have been well equipped with the knowledge and skills to articulate what she wants and needs, and able to distinguish for herself good and bad professionals. This scenario is my ideal. The steps don’t have to go in this particular order. The information presented here is for you to play around with, and find out what’s best for your situation.

You may ask, where does one begin to seek out information to improve one’s financial literacy? I suggest you follow my blog and my social media, and also check out my Resources page. The Resource page is a work in progress and I update relevant materials.

Men Promoting Women’s Financial Literacy

Next, let’s discuss how the men in our lives (e.g., husbands, fathers, grandfathers, brothers, boyfriends, friends) can do their part to help promote women’s financial literacy. In a future post we’ll take a look at how women can help each other.

Below, I share two examples to illustrate the teaching and learning process, and how this combined process happened organically.

A). When it comes to building financial confidence and becoming financially competent, I have my husband to thank. He exposed me to the investing world and long-term financial planning very early on in our relationship. One of his earliest gifts to me was Warren Buffet’s “The Making of an American Capitalist“. Although it took me a long time to jump both feet into the wagon and began sharing financial responsibilities with him, subconsciously through osmosis I learned from him bits and pieces on financial planning and about our financial situations.

Taking advantage of technology, he also loved sharing personal finance articles through emails and text messages with me. Even though I used to just causally scan through the articles, my brain apparently took notice and retained certain pieces of information. Despite my luke-warm enthusiasm toward financial planning (and I’m sure he noticed after all those tries), my husband was persistent and has patience! He never gave up on me or my potentials.

Being a non-native English speaker, my husband knows very well that I have a very difficult time getting the number of zeros correct when expressing a large number in English (though I had the number correct in my mind). To this date I still confuse others with my zeros (e.g., I would say 10 thousand when I meant 100 thousand or vice versa). Even as I’m writing this I have to consciously think about how many zeros are in 100 thousand. The Chinese have a different system dealing with zeros after the 1. I even drive myself crazy as I have a hard time getting my numbers across. Yet, my husband exhibits so much patience with me each time.

Early on in my learning journey when I encountered technical articles or hardcore financial concepts, I didn’t try hard to study and understand the information on my own. I went to my husband asking him to dissect apart each piece for me. He exhibited so much empathy. He learned everything he knew about personal finance on his own. In addition to sharing with me his wide repertoire of knowledge on personal finance, my husband was always ready to provide moral support. He gave me the time and space to digest information.

My learning really picked up early this year (2016) when I decided for myself that financially literacy is a very essential life skill. Since then, I’ve made it a high priority to learn the financial language. Nowadays, my husband and I are sharing financial knowledge and information back and forth with each other. It is no longer a one-way street.

When helping a partner learn about household financial situations, Investopedia has a great article, “Teaching Your Partner About Household Finances“. I highly recommend this article, whether you are single or married. The steps covered in this article are useful for anyone in any situation who wants to get a clear picture of his or her finances. My husband and I weren’t aware of this article at the time we got started. We learned about it much later. We covered most, if not all, the steps though.

B). The other example is about a girlfriend who got interested in long-term financial planning and investing through a male friend, named Jeff. Jeff was already well-versed in the stock market. He had tax deferred accounts, brokerage accounts, and retirement accounts. He was invested in both international and U.S. individual stocks, index funds, municipal bonds and international bonds. My girlfriend, on the other hand, didn’t bother to set up a 401k through her work nor did she contribute to a Roth IRA. She didn’t see or didn’t know the benefits of such accounts.

One day Jeff asked my friend how she was allocating her 401k investments. When my friend told Jeff that she wasn’t contributing to her 401k, Jeff started giving her all reasons how she could benefit from such account. The rest is history. My friend was receptive to what Jeff had to say and teach her, and Jeff was ready share his own knowledge. Thanks to that conversation Jeff brought up five years ago, my friend nowadays has tens of thousands of dollars saved toward her retirement. From this example, we can learn to never underestimate the power of a causal conversation among friends. In this case, Jeff could have been my friend’s brother, father, grandfather or boyfriend.

As Example B demonstrated, learning doesn’t happen just during teaching moments. Each time we are being asked a question, the question itself might contain relevant information we can apply in our own lives.

If you’re a female reading this, tell the males in your life who you trust, to begin asking you finance-related questions.

If you’re a father, support your wife pursuing financial literacy. Then, teach your daughters with what you know about personal finance and financial planning. Your daughters are likely paying attention to the way you support your wife. Hopefully, your daughters will begin to advocate for themselves in their own relationships. If you’re a grandfather, take time to discuss financial topics with your granddaughters, too. Grandparents can have profound impact on their grandchildren’s financial paths.

If you’re a brother, support your sisters and significant other pursuing financial literacy. Do this with your female friends, too.

Let us all get the conversations started, and talk about personal finance and long-term financial planning with those who are close to us. This is what caring and love is about. This is an intergenerational effort! It’s my hope that together, we play a part setting a new course of history for women and financial literacy around the globe. Remember, these women are our wives, our daughters, our sisters and our friends.

Do you have the resources and support you need to make wise financial decisions? What else would help?

What does financial confidence feel like to you?

Who are the male figures in your life that you associate with learning about personal finance?

Like what you’ve just read? I encourage you to subscribe to my free weekly newsletter that goes out every Monday to receive updates on new posts. Please share my blog and contents with your family and friends, too. Financial literacy is one of the best gifts you can give yourself and loved ones.

Jolie

October 2, 2016I could just cry, You have hit the nail on the head here. Thank you for your love and commitment to our success.

Nina

October 10, 2016Thank you for your support, Jolie!