Hello readers. Even though it’s not officially summer, it seems like that’s what’s been on everyone’s mind around here. Pool and BBQ parties are in full swing. I briefly looked at upcoming free family events in the city and there are some great ones I plan taking my daughter to this month.

My family and I recently came back from a week-long vacation by the Gulf of Mexico. We spent half of our time in Port Aransas (Mustang Island and North Padre Island) and the other half in South Padre Island (including Port Isabel).

What’s my impression of the Texas coast (several years ago, I also visited Galveston and Rockport)? My view is pretty biased considering that I’ve lived in the California coast for over a decade and have visited some amazing beaches and seen beautiful water in other parts of the world. There’s not much to say about the Texas coast other than it is a good place that tides me over (my craving for beach and sun) until our next vacation to the French Riviera (or other parts of the Mediterranean) or Hawaii.

With that said, I did enjoy my time there. We visited a different beach every day, playing in the sand and putting our feet in the warm gulf water (a very good surprise!). It was a very slow-paced vacation, which was very different than most of the other vacations we’ve had. There wasn’t much else to do other than heading to the beach which was precisely the part that made this vacation very relaxing. We took our time enjoying hour-long breakfasts, meandering along the beach, soaking in the sun and building sandcastles. We also took the time to watch the sunset and go on short cruises.

Of the 8 years that my husband and I have been together, we’ve probably traveled 20 times together. And this most recent trip was the easiest and most relaxing…relaxing in the sense that time didn’t matter as there was no set itinerary.

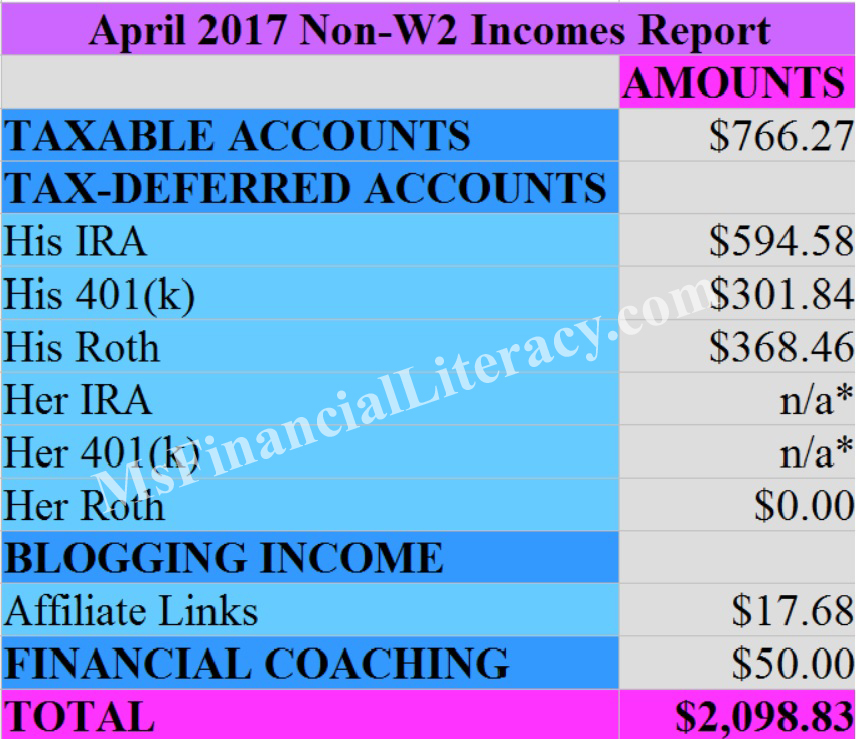

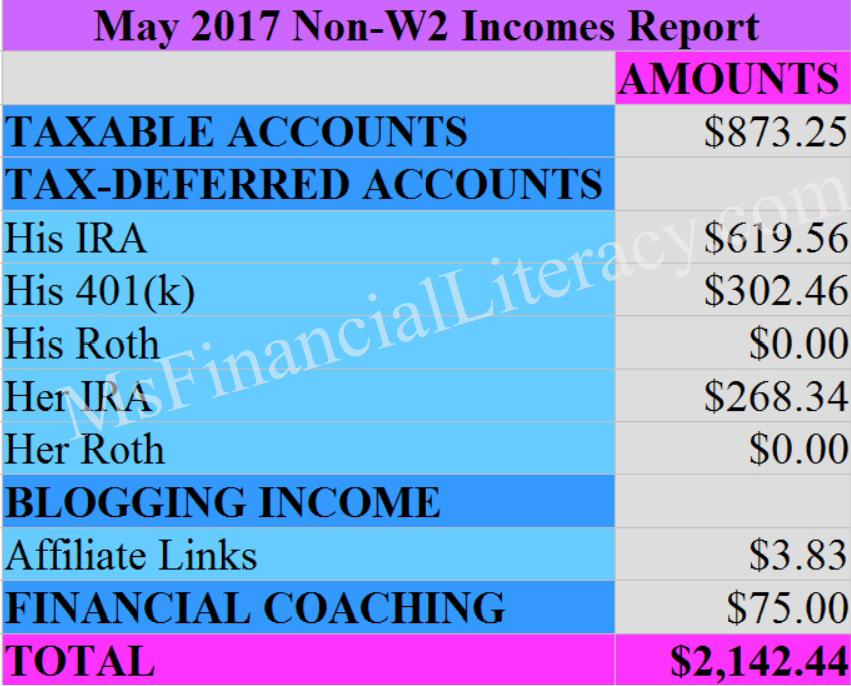

When we arrived home the following day, we reviewed our finances. And below is a summary of our May 2017 Non-W2 incomes report. The total amount is very similar to that of April 2017. Neither my husband nor I received any dividend/interest payments in our Roths. You’ll also notice that I took out the row tracking “Her 401(k)” and added in a new row now tracking “Her IRA”.

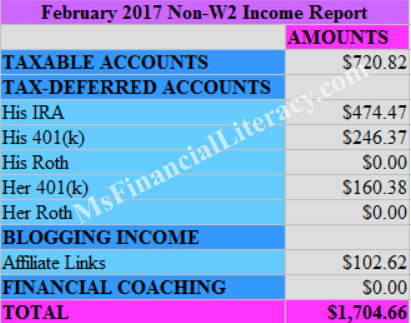

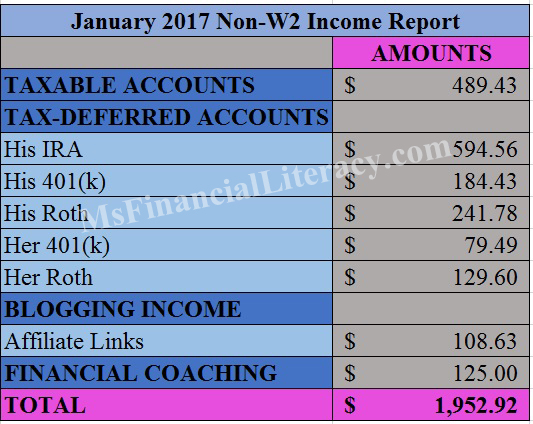

We started tracking these numbers back in December 2016. You can view our past reports and why we’re doing this here. We use Personal Capital, a free financial tool, to track our net worth, view our investment performance, analyze our asset allocations and project our retirement goals. I wrote a comprehensive review of Personal Capital on another post. I encourage you to check it out.

This is it for now. Thank you for stopping by. I’m looking forward to our June numbers. According to my husband, June should be a great month for us. We’ll see. As stated before, this is the first time we’re tracking our non-w2 incomes systematically over a period of time.